What are the best strategies to navigate high mortgage rates in luxury real estate in 2025?

As mortgage rates rise in 2025, luxury real estate investors need effective strategies to adapt. Here are the top approaches:

- Refinancing Options: Explore refinancing opportunities to lock in better rates in the future, especially if interest rates decrease.

- Loan to Value Ratio: Keep a low LTV ratio to lower risks and improve loan approval chances.

- Alternative Financing: Look into hard money loans and private lenders for more flexibility when traditional mortgage rates are unfavorable.

- High-Demand Locations: Invest in locations with strong real estate market performance, like the Bay Area, for long-term growth.

- Mortgage Insurance: Know when to use mortgage insurance and how it impacts your financing options.

By applying these strategies, investors can minimize the impact of high mortgage rates and succeed in luxury home markets. Keep track of mortgage interest rates trends and stay adaptable to the evolving real estate investment landscape in 2025.

Key Takeaways

- Understanding the current luxury real estate market dynamics is crucial for making informed investment decisions.

- High-interest mortgage rates can pose significant challenges for investors, but there are strategic financing options available.

- The taxa de juro and mortgage rate can significantly impact the imobiliária market, and investors must be aware of these changes.

- Investing in luxury properties requires a deep understanding of the market and the ability to navigate high-interest mortgage rates.

- By staying informed and adapting to the changing market, investors can still achieve a significant return on investment despite the high-interest mortgage rates.

- Exploring alternative financing options, such as private banking solutions, can help investors mitigate the risks associated with high-interest mortgage rates.

Current Luxury Real Estate Market Dynamics

The luxury real estate market is complex and changes often. It’s influenced by things like interest rates, economic trends, and where you are. For those looking to investimento imobiliário, knowing these changes is key. The mercado imobiliário goes up and down, and now, interest rates are rising. This can change how valuable properties are and how attractive they are to investors.

In the área da baía, the market is changing. Vendedores are adjusting to higher interest rates. This makes the market more competitive, giving buyers more power to negotiate. To succeed, it’s important to keep up with the latest in the luxury real estate market.

- Regional market variations and their impact on property values

- The role of international investment trends in shaping the luxury real estate market

- The effects of rising interest rates on investment attractiveness and property prices

By understanding these factors and keeping up with market trends, investors and vendedores can make smart choices. They can handle the challenges of high-interest mortgage rates in the mercado imobiliário, especially in the área da baía.

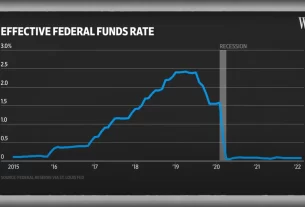

Understanding Today’s Mortgage Rate Environment

Taxas de juros de hipotecas are crucial when buying luxury properties. The rates change often, so it’s key to know what affects them. This info helps investors make smart choices and avoid risks from high rates.

The economy’s health also impacts mortgage rates. When the economy grows, rates go up, making loans pricier. In these times, refinanciamento can help. It lets investors get better rates and lower monthly payments.

Here are some important things to remember about today’s mortgage rates:

- Fluctuating interest rates can impact the cost of borrowing

- Refinanciamento can be a viable option for reducing mortgage costs

- Understanding the factors influencing mortgage rates can help investors make informed decisions

Staying updated on mortgage rates and considering refinanciamento can help investors. It’s vital to watch taxas de juros de hipotecas and adjust plans as needed. With the right info and planning, investors can succeed in the current rate environment.

Strategic Financing Options for Luxury Properties

Investing in luxury properties means looking at different financing options. The relação empréstimo/valor is key because it affects the investment’s cost. Luxury properties need a lot of money, and the right financing can make or break the investment.

Investors might look into empréstimos de dinheiro duro instead of traditional mortgages. These loans are flexible and quick, but they have higher interest rates. Traditional mortgages, however, offer stability and lower rates but take longer to get.

It’s important to think about the pros and cons of each choice. Also, consider seguro de hipoteca to protect the investment.

Some important things to think about when financing luxury properties include:

- Evaluating the loan-to-value ratio to determine the optimal financing amount

- Assessing the interest rates and repayment terms for each financing option

- Considering the role of seguro de hipoteca in protecting the investment

By carefully looking at these points and exploring different financing options, investors can make smart choices. This helps secure the best financing for their luxury property investments.

Technology’s Role in Luxury Property Financing

Technology has changed how we finance luxury properties. Cadeia de blocos and tecnologia blockchain have made the real estate world more secure, open, and efficient. This is especially true for luxury properties, where big deals need solid financing.

Blockchain technology is leading this change. It uses a secure, shared ledger to record who owns what and when. This cuts down fraud and makes buying and selling luxury homes easier.

Also, digital lending platforms are making a big difference. They let investors see many financing options. This way, they can find the best deal for their needs. Digital platforms make luxury property financing simpler and more confident.

Key Benefits of Technology in Luxury Property Financing

- Enhanced security and transparency through cadeia de blocos and tecnologia blockchain

- Streamlined financing process through digital lending platforms

- Increased efficiency and reduced risk in luxury property transactions

As the luxury property market keeps growing, technology’s role will become even more crucial. By using cadeia de blocos and tecnologia blockchain, and digital lending platforms, everyone can stay on top. They can confidently handle the complex world of luxury property financing.

Negotiation Strategies in High Mortgage Rate Markets

Understanding tendências das taxas de hipoteca is key when mortgage rates are high. This knowledge helps investors make smart choices, whether buying a home or refinancing. The current housing market and valores de casa are important in these talks.

To negotiate well, investors need to know a few things:

- Market trends: Keep up with the latest tendências das taxas de hipoteca to guess market shifts.

- Property value: Know the valores de casa in your area to make strong offers or negotiate better prices.

- Financing options: Look into different financing choices for the compra de casa to get the best deal.

By thinking about these points and staying current with the market, investors can craft good negotiation plans in high mortgage rate times.

Risk Management and Property Insurance

Investing in luxury properties means you need to think about risk management and property insurance. Knowing about seguro de hipoteca helps reduce risks. Property insurance is key to protecting your assets in investimento imobiliário.

In the United States, luxury property investors face ups and downs in valores de casa. It’s crucial to have a solid insurance plan. This plan should include seguro de hipoteca to guard against losses. This way, investors can keep their investimento imobiliário safe and its value intact.

- Assess the property’s value and adjust the insurance coverage accordingly

- Review and update the insurance policy regularly to reflect changes in the property’s value

- Consider additional coverage options, such as flood or earthquake insurance, depending on the property’s location

By being proactive with risk management and property insurance, luxury property investors can safeguard their assets. This ensures a secure financial future for their investimento imobiliário.

Conclusion: Making Informed Investment Decisions in Today’s Market

The luxury real estate market faces high mortgage rates. Investors need to understand the current market well. They should look at regional differences and financing options to succeed.

Investors can use smart financing, negotiation, and risk management to do well. They can adapt and make smart choices, even with tough mortgage rates. This way, they can reach their investment goals.

Knowing what to do is crucial in the luxury real estate world. By using the tips from this article, investors can handle high-interest rates. They can find great investment chances in the changing real estate scene.

FAQ

How can I navigate high-interest mortgage rates when investing in luxury properties?

To deal with high-interest mortgage rates in luxury properties, you need a smart plan. Know the market, how rates are rising, and your financing choices. This helps you make smart choices and lower risks.

What are the current trends in the luxury real estate market?

Luxury real estate is shaped by many things. This includes how rates affect property values, regional differences, and global investment trends. Keeping up with these trends helps you make better investment choices.

How do I understand the current mortgage rate environment?

Today’s mortgage rates are changing a lot. This affects how much you pay for luxury property loans. Knowing what changes rates and your refinancing options can help you manage risks.

What strategic financing options are available for luxury property investments?

Luxury properties need a lot of financing. Choosing the right loan can greatly impact your investment. Options include hard money loans, traditional mortgages, and private banking. Knowing about loan-to-value and mortgage insurance helps you pick the best option.

How is technology changing the luxury property financing landscape?

Technology is big in luxury property financing. It includes blockchain for safer deals and digital lending for easier borrowing. Knowing about these tech changes helps you navigate financing better.

What negotiation strategies can I use in high mortgage rate markets?

In high rate markets, good negotiation is key. Knowing about rate trends and the housing market helps you negotiate better. This is true for buying, selling, or refinancing.

How can I manage the risks and insurance considerations in luxury property investments?

Managing risks in luxury properties is vital. Property insurance is a big part of this. Understanding insurance, protecting property values, and knowing tax benefits helps you manage risks well. This ensures your investments last long term.