What Are the Best First-Time Homebuyer Programs in 2024?

When it comes to first-time homebuyer programs, several options can make homeownership more accessible despite high mortgage rates:

- FHA Loans: The Federal Housing Administration (FHA) offers loans with as little as 3.5% down, ideal for those with limited savings or lower credit scores.

- Down Payment Assistance Programs: Various states and local programs offer financial aid for down payments, which can alleviate some of the upfront costs.

- Conventional Loans with Private Mortgage Insurance (PMI): If you have a smaller down payment, PMI may be an option to help secure a loan.

By exploring these programs, you can find the right fit for your budget and credit profile.

What Are the Requirements for First-Time Homebuyer Loans?

First-time homebuyer loan requirements typically vary depending on the loan type, but the key criteria include:

- Credit Score: A credit score of at least 580 is required for FHA loans to get the minimum 3.5% down payment. For conventional loans, a score of 620 or higher is preferred.

- Down Payment: While some programs require as little as 3% down (like FHA loans), aiming for 20% can help avoid PMI and secure better mortgage rates.

- Income Limits: Some programs have income restrictions, so it’s essential to check eligibility based on your location and financial situation.

- Debt-to-Income Ratio (DTI): Many lenders prefer a DTI ratio of 43% or lower to ensure you can manage monthly mortgage payments comfortably.

Can You Get First-Time Homebuyer Loans with Zero Down?

Yes, it is possible to secure first-time homebuyer loans with zero down, but the options are limited:

- VA Loans: Available for veterans and active-duty service members, VA loans require no down payment and have competitive interest rates.

- USDA Loans: The U.S. Department of Agriculture offers loans to eligible buyers in rural areas, often with no down payment required.

- Down Payment Assistance Programs (DAPs): Some local and state programs provide grants or loans to help cover the down payment, which can result in zero down payment requirements.

How to Navigate the High Mortgage Rate Landscape

While understanding mortgage rates and interest rates is essential, applying the right strategies is key to overcoming high rates.

1. Understand Mortgage Rate Dynamics

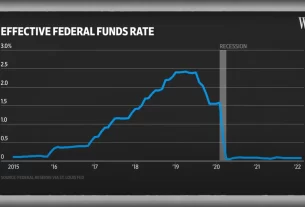

The Federal Reserve controls interest rates to manage inflation, and this directly impacts mortgage rates. By keeping an eye on the Federal Reserve’s policies and economic indicators like the Consumer Price Index (CPI), you can time your home purchase more effectively.

2. Leverage FHA Loans

FHA loans are designed for first-time buyers, allowing as little as 3.5% down. If you have a credit score above 580, this could be a great option to lower upfront costs. However, remember that FHA loans come with mortgage insurance.

3. Optimize Your Credit Score

Improving your credit score can directly impact the interest rate you’re offered. Here’s how:

- Pay bills on time: Your payment history accounts for 35% of your credit score.

- Reduce credit card balances: Aim to keep balances under 30% of your available credit.

- Avoid opening new accounts: Too many new accounts can hurt your score.

4. Work with a Skilled Realtor

A trusted real estate agent can help you find affordable properties and negotiate better deals, which is crucial in a high-interest environment. Their knowledge of the housing market can make a significant difference.

Strategies to Maximize Your Down Payment and Minimize Mortgage Rate Impact

Your down payment can significantly affect your mortgage terms, especially with high rates. Here are a few strategies to consider:

This video provides detailed insights on how to increase your down payment and reduce the impact of mortgage rates, with practical tips for first-time buyers.

1. Aim for a 20% Down Payment

A larger down payment can help you avoid Private Mortgage Insurance (PMI) and secure a better mortgage rate, ultimately lowering your monthly payments.

2. Down Payment Assistance Programs (DAPs)

Research Down Payment Assistance Programs in your state or locality. These programs often offer grants or low-interest loans to help with down payments.

3. Gifted Funds

If saving for a down payment is difficult, consider using gifted funds from family or friends, which can significantly reduce your upfront costs.

4. Negotiating Seller Concessions

In some markets, sellers may be willing to cover some of your closing costs, freeing up funds for a larger down payment.

Alternative Financing Options for First-Time Homebuyers

If traditional mortgage options don’t work, consider these alternatives:

- Seller Financing: In this arrangement, the seller provides the financing directly, bypassing traditional lenders.

- Rent-to-Own Agreements: Lease a home with the option to buy later, which can give you more time to save and improve your credit.

- Assumable Mortgages: Some loans, like FHA and VA loans, are assumable, meaning you can take over the seller’s existing loan at the current interest rate.

Understanding Mortgage Rates and the Housing Market in 2024

As the housing market in 2024 continues to face pressure from inflation and interest rates, it’s important to understand the larger economic trends that impact mortgage rates:

- Federal Reserve Policies: The Federal Reserve’s decisions on interest rates are central to mortgage rate trends. By understanding these moves, you can plan your home-buying strategy accordingly.

- Inflation: Rising inflation typically leads to higher interest rates as the Federal Reserve increases rates to control the economy.

- Bond Yields and Economic Growth: Strong economic growth or increased bond yields can also push mortgage rates higher.

Boosting Your Purchasing Power: Credit Score and DTI

A strong credit score and a low debt-to-income ratio (DTI) are essential for securing a favorable mortgage rate.

- Check Your Credit Report: Regularly monitor your credit report for errors.

- Lower Your DTI: Reduce outstanding debts and aim for a DTI under 43% to increase your chances of approval.

- Increase Your Income: Finding ways to boost your income, such as taking on a side job, can help lower your DTI and improve your financial profile.

Conclusion: Making Homeownership Possible in 2024

While high mortgage rates in 2024 present challenges, there are many ways to overcome these hurdles. By understanding the dynamics of mortgage rates, utilizing FHA loans, improving your credit score, and leveraging down payment assistance programs, you can make homeownership a reality. Work closely with a trusted realtor, stay informed about market trends, and utilize the strategies in this guide to maximize your purchasing power.

Ready to take the next step? Contact a trusted realtor today to explore homes that fit your budget and goals. Don’t let high mortgage rates hold you back—there are always ways to make your dream home a reality