Why Did U.S. Stocks Rebound This Week?

U.S. stocks rebounded after a week of losses due to renewed investor confidence and strong corporate earnings. The S&P 500, Dow Jones, and Nasdaq all posted gains, signaling a potential stock market recovery as concerns over inflation and interest rates ease.

Quick Insights: Key Stock Market Trends

Before diving deeper, here are the most important takeaways from this stock market rebound:

- S&P 500 and Nasdaq surged as investor sentiment improved.

- Tesla, Ulta, and Chipotle reported strong earnings, fueling confidence.

- Retail and tech sectors led the charge, indicating a shift in consumer behavior.

- Federal Reserve’s softer stance on interest rates contributed to the rally.

If you’re looking for investment strategies amid this stock market recovery, here’s what you need to know.

Why This Stock Market Rebound Matters

The recent rally is a crucial turning point for investors who weathered the downturn. Key reasons behind the stock market’s recovery include:

- Federal Reserve’s shift in tone, suggesting a possible slowdown in rate hikes.

- Stronger earnings reports from major companies such as Tesla, Ulta, and Chipotle.

- Consumer spending resilience, particularly in the retail and tech sectors.

- Improved economic data, including a slowdown in inflation and job market stability.

According to Bankrate, analysts expect moderate growth in 2025, with the S&P 500 projected to climb by 7%. This optimism is fueled by strong corporate earnings and improving economic conditions.

What’s Driving the Stock Market Rebound?

1. Tech Stocks Lead the Charge

Tech giants, including Tesla and Nvidia, saw strong recoveries, fueled by optimistic earnings reports and AI-driven innovations. Investors are regaining confidence in the sector, betting on long-term growth.

The Magnificent 7 stocks—Apple, Microsoft, Tesla, Nvidia, Alphabet, Meta, and Amazon—continue to dominate market performance. Analysts at LiteFinance predict that these companies will remain key drivers of growth in 2025.

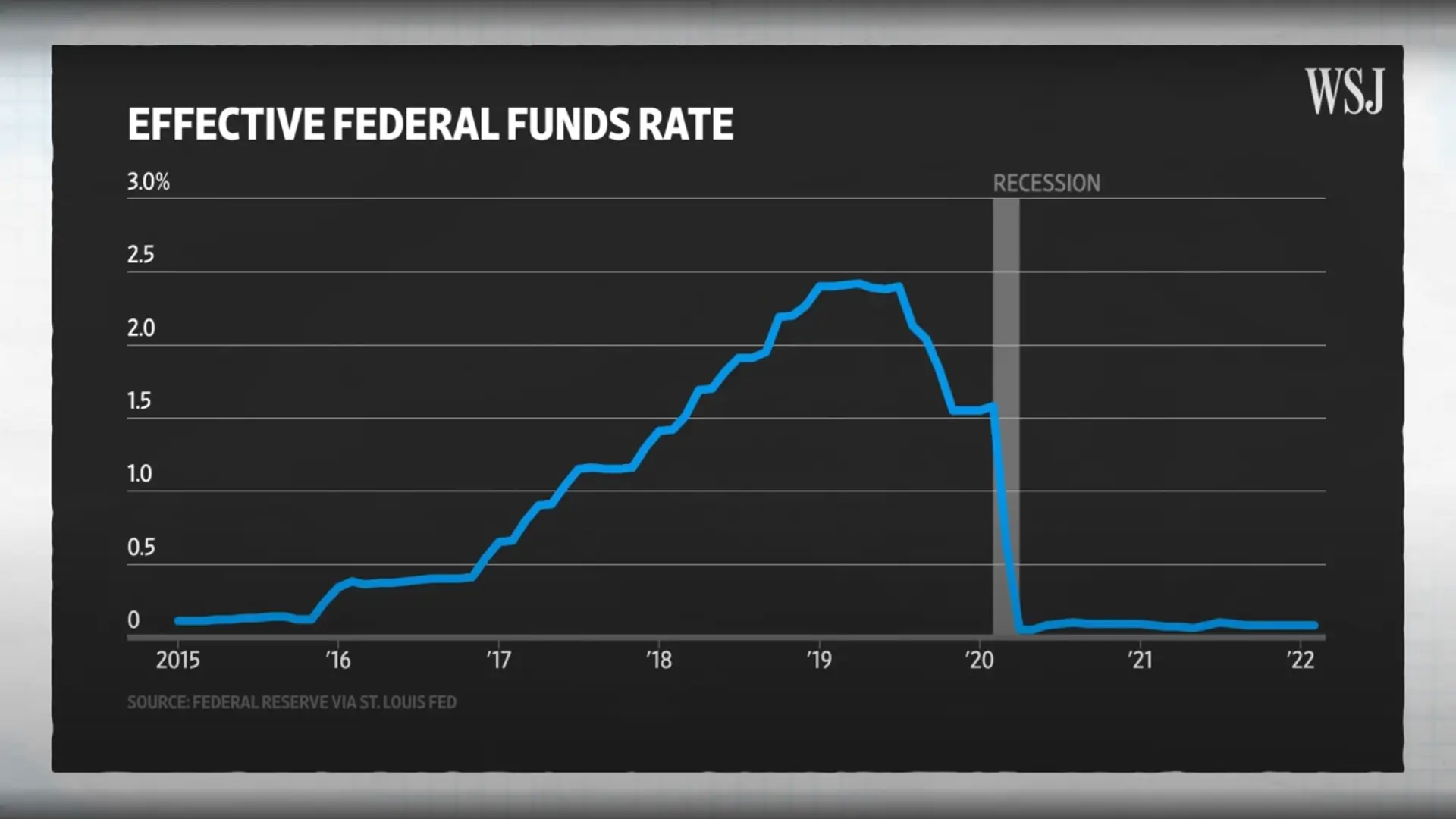

For an in-depth look at how interest rates impact the stock market, watch this insightful video from The Wall Street Journal:

How the Fed Steers Interest Rates to Guide the Entire Economy | WSJ

In this video, experts explain how the Federal Reserve’s monetary policies shape stock market trends and the broader economy. It provides timely insights into the Fed’s role in managing interest rates and their direct impact on investor confidence.

2. Retail Giants Bounce Back

Retail stocks like Ulta Beauty, Chipotle Mexican Grill, and Dollar General experienced significant gains as consumer spending remains resilient. Earnings reports showed strong demand for discretionary products despite inflationary pressures.

Chipotle reported an impressive 10% rise in quarterly revenue due to increased menu prices and robust customer traffic. Similarly, Ulta Beauty’s sales surged by 8%, driven by strong demand for premium beauty products.

3. Federal Reserve’s Softer Stance on Rate Hikes

Investors reacted positively to signals that the Federal Reserve may slow its rate hikes. According to Bankrate, the Fed is expected to cut interest rates three times in 2025, bringing borrowing costs down to a range of 3.5–3.75%. This easing of monetary policy has reduced fears of an aggressive tightening cycle that could push the economy into recession.

Will the U.S. Stock Market Continue to Recover?

While this rebound is encouraging, analysts warn that volatility is still a factor. The stock market’s direction will depend on:

- Upcoming Federal Reserve meetings and interest rate decisions.

- Corporate earnings results from key players like Tesla and Chipotle.

- Consumer sentiment and spending trends.

- Geopolitical developments that could impact global markets.

According to Edward Jones, wage growth outpacing inflation will likely support continued consumer spending in 2025, providing a solid foundation for further stock market gains.

How Investors Can Benefit From This Stock Market Rally

Investors who took advantage of the market dip are seeing gains as stocks recover. Some strategic moves include:

- Buying strong-performing stocks at discounted prices: Companies like Tesla and Nvidia remain attractive due to their growth potential.

- Diversifying portfolios: Adding defensive assets like healthcare stocks or bonds can help hedge against volatility.

- Monitoring Federal Reserve actions: Anticipating interest rate changes can inform investment decisions.

Example: Tesla’s Resurgence

Tesla’s stock dropped nearly 15% last week but has since rebounded by gaining 10% in just a few days after reporting stronger-than-expected quarterly deliveries and unveiling new AI-powered features for its vehicles.

Chipotle also saw a 7% increase following its earnings report, which highlighted robust same-store sales growth despite rising food costs.

Key Takeaways for Stock Market Investors

- The U.S. stock market rebounded after a week of losses, with tech and retail stocks leading the charge.

- Investors are optimistic about the Federal Reserve slowing rate hikes.

- Companies like Tesla, Ulta Beauty, and Chipotle posted strong earnings, boosting stock market confidence.

- Market volatility remains high; future trends depend on economic data and Fed decisions.

Conclusion – What’s Next for the U.S. Stock Market?

This rebound offers a glimpse of hope for investors but also underscores the importance of caution amid ongoing uncertainties. By staying informed about economic trends and diversifying investments, investors can make strategic decisions to capitalize on stock market movements.

💡 Take Action Now! Follow expert analysis on platforms like Bloomberg or CNBC to adjust your investment strategy effectively.

FAQ Section

Why did the U.S. stock market rebound after a week in the red?

- Stronger earnings reports from major companies, a shift in Federal Reserve policy toward easing monetary conditions, and resilient consumer spending fueled the recovery.

Which stocks led the stock market rebound?

- Tech giants like Tesla and Nvidia, along with retail leaders such as Ulta Beauty and Chipotle Mexican Grill, were key contributors to the rally.

Should I invest now or wait for more stability?

- While opportunities exist during rebounds, volatility remains high. Consider consulting a financial advisor before making significant investment decisions.

How can I stay updated on stock market trends?

- Follow reliable financial news sources such as Bloomberg, CNBC, or Investopedia for real-time updates.

Will Federal Reserve decisions impact future stock market trends?

- Yes! Interest rate changes significantly influence investor sentiment and sector performance within the stock market.