Is the S&P 500’s recovery sustainable after a $5 trillion selloff?

Yes, but risks remain. The S&P 500 has surged 15% from its March 2025 low, driven by Federal Reserve policy shifts, strong earnings from Microsoft and Meta, and easing inflation. However, trade wars and slowing growth could test the rally.

The Rollercoaster Ride of the US Stock Market

The S&P 500 has staged one of the most dramatic comebacks in recent history, clawing back $5 trillion in market cap after a brutal three-week selloff. This rebound has reignited debates: Is this the start of a new bullish market, or a temporary relief rally before another downturn?

For investors, the stakes are high. With the Federal Reserve walking a tightrope on interest rates, Goldman Sachs revising targets, and sectors like energy stocks and tech giants like Microsoft driving momentum, understanding the forces at play is critical. Below, we break down the drivers, risks, and investment strategies to navigate this volatile landscape.

Why the S&P 500 Recovery Matters Now

The financial market is at a pivotal juncture. After plunging to 5,500 in March 2025—a 10% drop from its February peak—the S&P 500 has rebounded to 6,100, fueled by:

- Federal Reserve signals of potential rate cuts in late 2025.

- Blowout earnings from Microsoft (cloud/AI growth) and Meta (advertising rebound).

- Cooling inflation, with CPI dropping to 3.1% YoY in March.

But with market predictions split between optimism and caution, how should you position your portfolio?

5 Catalysts Fueling the S&P 500 Rally

1. Federal Reserve Policy Shift: The Rate Cut Lifeline

The Federal Reserve has hinted at pausing rate hikes, with Chair Jerome Powell acknowledging “meaningful progress” on inflation. Futures markets now price in a 60% chance of a rate cut by September 2025. Lower rates reduce borrowing costs for companies like Microsoft and boost investment in growth sectors.

Why It Matters:

- Tech stocks thrive in low-rate environments (e.g., Meta’s 22% EPS growth in Q1 2025).

- Energy stocks like ExxonMobil benefit from cheaper capital for green transitions.

2. Earnings Powerhouse: Microsoft, Meta, and the AI Boom

Corporate earnings are beating expectations, with S&P 500 companies projected to deliver 14.5% EPS growth in 2025 (Yardeni Research). Key drivers:

- Microsoft: Azure AI revenue surged 28% YoY, lifting its market cap to $3.1 trillion.

- Meta: Ad revenue jumped 18% as Reels monetization accelerates.

- Nvidia: AI chip demand pushed Q1 sales to $26 billion, up 34% YoY.

Cognitive Bias Alert: Authority Bias

Analysts at Morgan Stanley and Citi endorse the rally, citing “oversold conditions” and a floor of 5,500 for the S&P 500.

3. Sector Rotation: From Oil News to Tech Dominance

While energy stocks lagged due to falling oil prices (-12% since January 2025), tech and healthcare are leading:

- Tech Sector: +20% EPS growth in 2025 (Yardeni).

- Healthcare: UnitedHealth’s telehealth expansion drove 18% profit growth.

Investment Strategy Tip:

Diversify into sectors with “under-the-radar” growth, like copper (+39.6% EPS forecast) and airlines (+20.3%).

4. Retail Investors Pile In: Reddit IPO Frenzy 2.0

The Reddit IPO resurgence mirrors 2021’s meme-stock mania, with retail traders fueling rallies in beaten-down stocks like AMC and GameStop. Trading app downloads spiked 40% in March, per App Annie.

Risk Alert:

Volatility could surge if retail enthusiasm fades.

5. Global Tailwinds: China’s Rebound and Oil News

- China’s stimulus package boosted industrial metals (copper +15% in March).

- Oil news remains mixed: Brent crude stabilizes at $75 amid OPEC+ supply cuts.

Risks That Could Derail the Rally

1. Trade War Escalation: The Trump Factor

President Trump’s new tariffs on Canadian steel/aluminum rattled markets in March, erasing $800 billion in market cap in a week. Morgan Stanley warns the S&P 500 could drop to 5,100 if tensions worsen.

2. Federal Reserve Policy Missteps

If inflation rebounds, the Fed may delay rate cuts, pressuring rate-sensitive sectors like real estate (forecasted 7.7% EPS growth).

3. AI Stock Bubble Fears

Nvidia’s 17% drop since February highlights fragility in AI-driven rallies. Goldman Sachs cautions: “Valuations assume perfection.”

4. Reddit IPO Volatility

Retail-driven pumps could reverse sharply, as seen in 2021.

Historical Precedent: Lessons From Past Recoveries

| Event | S&P 500 Drop | Recovery Time | Key Driver |

|---|---|---|---|

| 2008 Financial Crisis | -57% | 4 years | Fed stimulus, bank bailouts |

| 2020 COVID Crash | -34% | 6 months | Tech/growth stock surge |

| 2025 Selloff | -10% | 3 weeks (so far) | AI earnings, Fed pivot |

Takeaway: Markets rebound, but sectors rotate. In 2025, AI and healthcare are the new leaders.

Expert Market Predictions: Bull vs. Bear

Bull Case (Morgan Stanley, Citi): S&P 500 to 6,500

- “AI productivity gains and Fed easing will drive the next leg,” says Mike Wilson.

- Microsoft and Meta could rally another 20%.

Bear Case (Goldman Sachs, RBC): 6,200 or Lower

- “Valuations are stretched, and earnings face macro risks,” argues David Kostin.

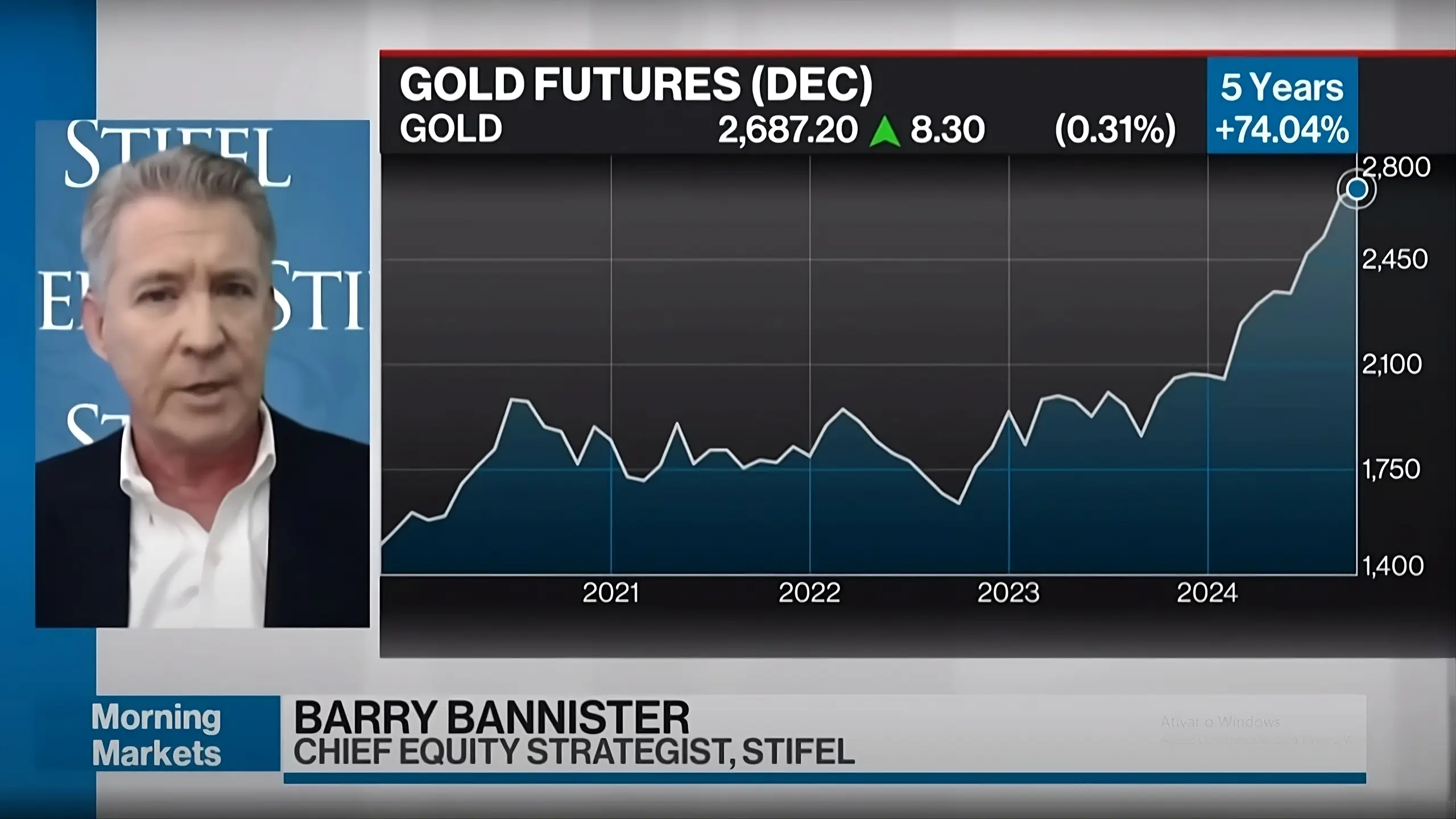

Watch This Video Analysis

Stifel’s strategist predicts a 10% rally followed by a 26% plunge, citing overvaluation and Fed policy risks.

Investment Strategies for 2025’s Volatile Financial Market

For Long-Term Investors

- Buy Dips in Tech: Microsoft (AI cloud), Meta (VR/AR growth), and Nvidia (AI chips).

- Hedge with Energy Stocks: Chevron (4.2% dividend) and ExxonMobil (carbon capture investments).

For Traders

- Play Reddit IPO Volatility: AMC, GameStop, and crypto-linked stocks.

- Short Overvalued AI Stocks: Monitor market cap/revenue ratios.

For the Cautious

- Diversify into Bonds: 10-year Treasuries yield 4.3%, a safe haven if the S&P 500 stumbles.

- Goldman Sachs Recommends: Consumer staples (e.g., Procter & Gamble).

The Bullish Market Playbook: 3 Stocks to Watch

- Microsoft (MSFT): AI-driven Azure growth and a $60 billion buyback program.

- ExxonMobil (XOM): Undervalued at 10x P/E with $15B annual buybacks.

- Coinbase (COIN): Crypto resurgence could boost trading strategies.

Conclusion: Navigating the US Stock Market in 2025

The S&P 500’s rebound is real—but fragile. While Microsoft, Meta, and AI innovation offer hope, risks like trade wars and Fed missteps loom. To thrive:

- Lean into sectors with strong earnings (tech, healthcare).

- Stay nimble with trading strategies.

- Never ignore cognitive biases: Combat FOMO with data-driven decisions.

💡 Pro Tip: Track the Federal Reserve’s June meeting and Q2 earnings from Microsoft (July 18) for market direction.

FAQ

Q: What caused the S&P 500’s $5 trillion selloff?

A: Trade wars, slowing growth, and an AI stock correction triggered the March 2025 crash.

Q: Which sectors are leading the recovery?

A: Tech (Microsoft, Meta) and healthcare, while energy stocks lag due to oil news.

Q: Is the Reddit IPO surge a good opportunity?

A: High-risk, high-reward. Use strict stop-losses in trading strategies.

Q: What’s the Federal Reserve’s next move?

A: Rate cuts are likely in late 2025 if inflation stays tame.

Q: How high can the S&P 500 go in 2025?

A: Bulls say 6,500 (Morgan Stanley); bears say 6,200 (Goldman Sachs).